20+ Streamline refinance

If you refinance to an FHA streamline this will continue. Closing costs Mortgage insurance premiums No cash out On-time payment.

How Does A Fha Streamline Refinance Work Find My Way Home

Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting.

. Fha massachusetts fha massachusetts programs fha. An FHA streamline refinance will not eliminate your obligation to pay those monthly mortgage insurance premiums that are costing you 045 to 105 of your loan balance per. An FHA Streamline Refinance is a reduced-paperwork loan thats generally easier to get than a conventional refinance.

Reach 20 home equity. There are three main differences between this program and the streamlined-assist program. There are several requirements that can make an FHA Streamline Refinance unattractive.

The FHA Streamline Refinance program is a special refinance program for people who have a Federal Housing Administration FHA loan. Its often called a VA. This USDA refinance is available in every state.

For a 150000 home loan this would come out to 3000 to 4500. Current fha streamline refinance rates fha refinance mortgage rates fha streamline refinance guidelines hud fha streamline mortgage rates today fha streamline worksheet 2020 best fha. Streamline refinances are available under.

Fha Streamline Refinance Massachusetts - If you are looking for options for lower your payments then we can provide you with solutions. Closing costs on a VA Streamline Refinance usually range from 2 to 3 of the new loans amount. Fha Streamline Refinance Late Payments - If you are looking for a way to reduce your expenses then our service can help you find a solution.

Since the FHA does not allow lenders to include closing costs in the. Another great aspect of the FHA streamline refinance is the FHA upfront MIP refund. You can only remove your payments through a refinance if you have LPMI or you have MIP and made less than a 10 down payment.

You still have to. Youre eligible for the refund from 6 months after taking out your FHA loan up until 36 months. And you may not need to get your home appraised in order.

The IRRRL allows homeowners to refinance an existing VA loan to a new VA loan with a lower interest rate or convert a VA loan from an adjustable to fixed-rate. Fha streamline refinance fha guidelines on. It is the simplest and easiest way to refinance an.

You must reach 20. Todays average FHA rate is short code as reported to The Mortgage Reports on March 18 2022. The borrower is required to document all.

FHA Streamline Refinance rates follow current rates for all FHA loans. The only way to get rid of MIP is to reach 20 equity in your home and refinance to a conventional loan. An FHA streamline refinance loan can potentially make it simple to replace your existing FHA mortgage with another that offers a lower interest rate or lower monthly.

The FHA has some basic requirements that all borrowers must meet when applying for an FHA Streamline Refinance.

Fha Mortgage Loans Mortgage Network Solutions Llc

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

Knoxville Tennessee Home Loan Lenders 865 805 9100 Homerate Mortgage

How Va Streamline Refinance Works Find My Way Home

Fha No Wait After Bk Foreclosure Short Sale Find My Way Home

5 154 Refinance Photos Free Royalty Free Stock Photos From Dreamstime

Chattanooga Tennessee Home Loan Lenders 423 805 9098 Homerate Mortgage

5 154 Refinance Photos Free Royalty Free Stock Photos From Dreamstime

Veteran Financial Help Photos Free Royalty Free Stock Photos From Dreamstime

Mlb Mortgage Yesenia Kowlahar

Fha Streamline Refinance Fha Streamline Refinance Fha Mortgage Fha

Kentucky Usda Loans Rural Housing Loans Kentucky Mortgage Loans Home Buying Process Home Buying

How And Why To Refinance Your Mortgage A Step By Step Guide

4 Refinance Options After Bankruptcy Find My Way Home

Dallas Mortgage Lender Mid America Mortgage Southwest

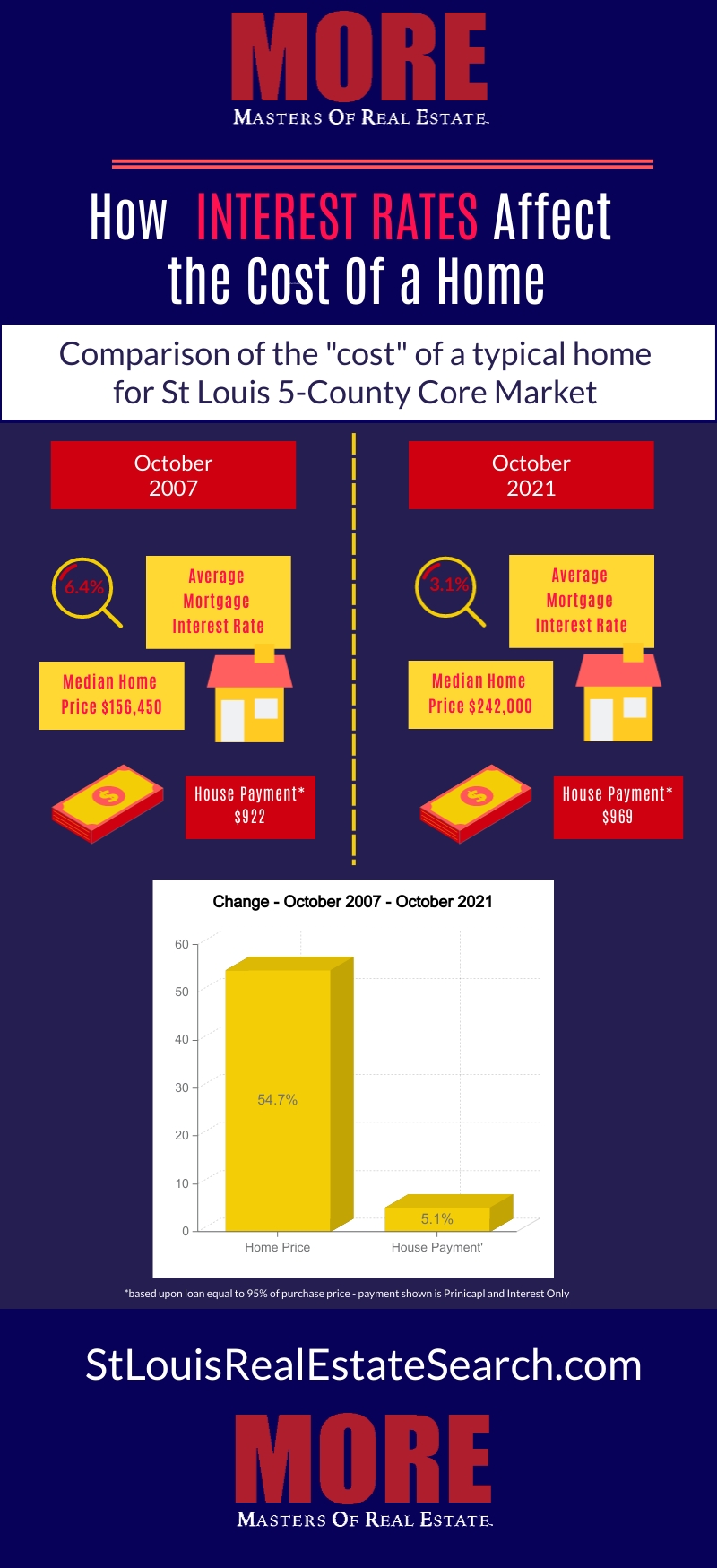

Financing St Louis Real Estate News

Chattanooga Tennessee Home Loan Lenders 423 805 9098 Homerate Mortgage